Revitalize Baltimore with BCL's CITC Program

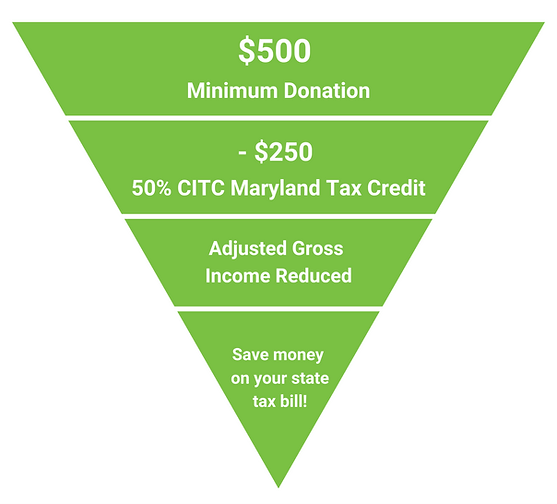

Invest in Baltimore's transformation through the Maryland Community Investment Tax Credit (CITC) program with Baltimore Community Lending. By donating a minimum of $500, you'll receive state income tax credits worth 50% of your contribution. Your support will directly fund the establishment of our Business Development and Resource Center, which aims to foster community development and drive positive change in underserved Baltimore neighborhoods. With BCL's $10,000 CITC award, you can make a lasting impact on the city you love and reduce your tax liability. Tax credits are limited, so act now to secure your spot and become a part of this transformative initiative. Your donation is the foundation for building a stronger, more connected community. Donate today and see the difference you can make.

Award Amount and Details:

· As a 501 c3 nonprofit organization, we have been awarded CITC Credits to distribute to donating entities on a first come first serve basis. For every dollar contributed at or above the minimum or qualifying value of $500, donors will receive a Maryland CITC tax credit equal to 50% of the value of their donation.

· All donations must be claimed for the tax year that BCL received them. Contributions may be in the form of check, and credit card, and are eligible for credit compensation up until the program end date.

To Qualify:

· Your gift must be at least $500. State tax credits begin at $250 (%50)

· BCL must have the tax credits available.

· The donor tax ID number (i.e. personal SNN or business EIN) on the checking or credit card account used- MUST batch the Maryland taxpayer account to receive the credit.

Your Contributions Support:

The Maryland Department of Housing and Development has awarded BCL in support of our revitalization, and the promotion of essential resources the Baltimore Community Lending: Business Development and Resource Center will provide. This state-of-the-art facility will offer tools and resources to help businesses thrive and become sustainable within the economic ecosystem. The newly acquired BCL headquarters and home to the Business Development & Resource Center meets a critical need to strengthen Baltimore’s small business ecosystem, creating jobs, driving economic opportunities and revitalizing communities. The BD&RC will offer connections to capital, business expertise, individualized technical assistance, and entrepreneurial coaching. Our team will provide unique, hands-on support to local and small businesses, helping them navigate complex regulatory environments, optimize operations, and implement the best practices. The Business Development and Resource Center will be a one-stop shop for Capital Plus, offering Financial Advisory Services, Real Estate Consultation, Personalized Mentorship Programs and more.

ELIGIBLE CONTRIBUTIONS:

Check or electronic contributions of $500 or more.

To be eligible for tax credits, please contact us to receive and fill out the CITC Donor Acknowledgement before or at the same time of the donation.

HOW TO CONTRIBUTE:

Make or pledge your donation today. BCL will follow up with a simple waiver form.

Tax Credits are limited. Tax Credits will be distributed on a first-come, first-served basis.

PLEDGE:

Following your pledge, Baltimore Community Lending will contact you with the Donor Acknowledgement form and link to make your contribution.

To pledge your support please click the link provided or scan the QR code.

Please contact Baltimore Community Lending at fundraising@bclending.org or 410-727-8590 for the Donor Acknowledgement form. After completing your donation, BCL will certify your contribution with the State of Maryland, who will then provide final official tax credit paperwork needed to accompany your state tax return.

For more information about the Community Investment Tax Credit Program, visit:

https://dhcd.maryland.gov/communities/pages/programs/citc.aspx