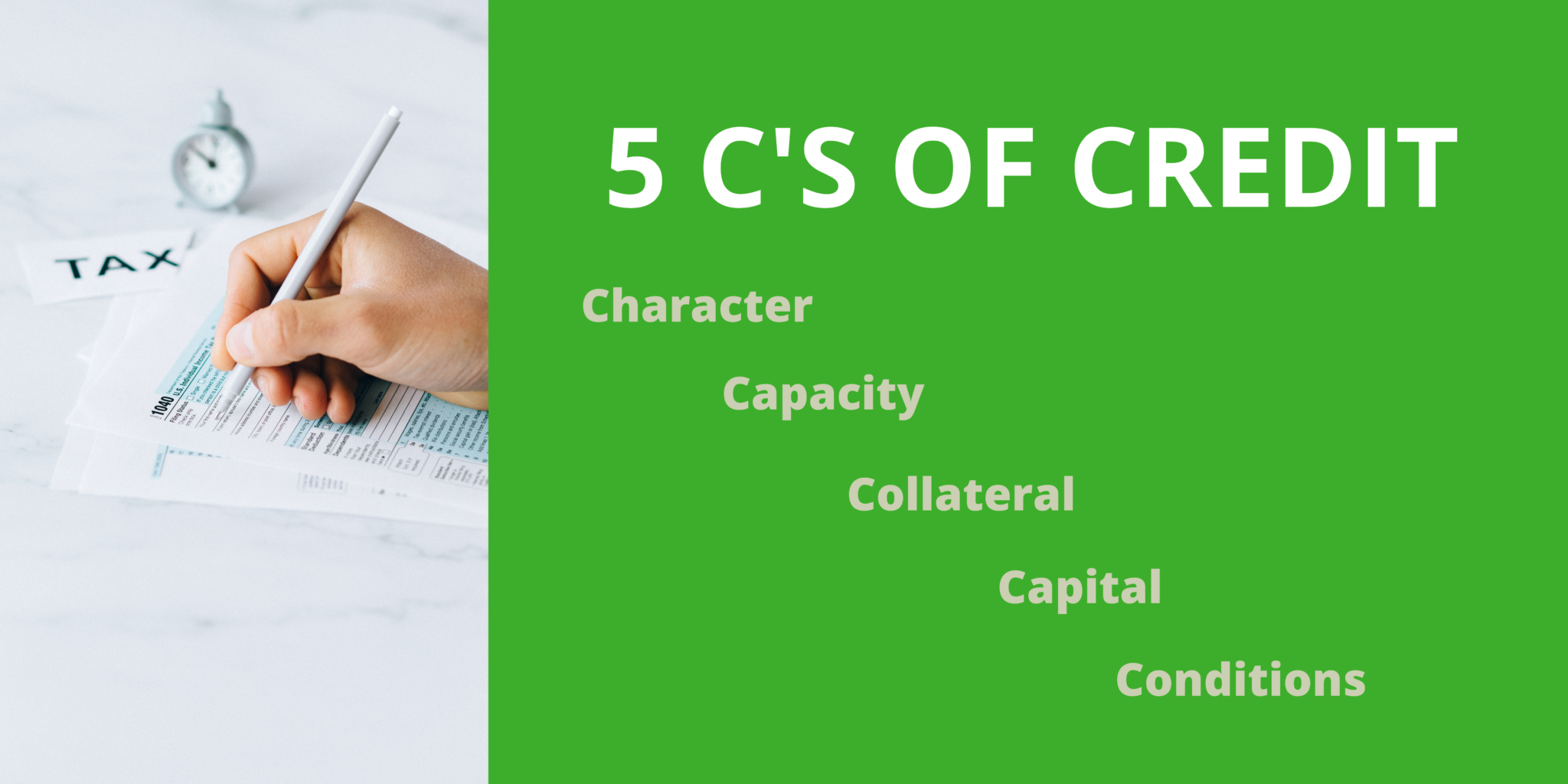

No matter the lender’s specific standards, your creditworthiness is evaluated based on the 5 C’s of credit:

- Character: Your track record for repaying debts and what your credit says about you as a potential borrower. Even if you’re requesting a loan for your small business or real estate project, the way you manage your personal finances is a major indicator for how you will manage the finances of your business or project.

- Capacity: Your ability to repay the loan based on your existing debt and current/anticipated income. Lenders want to be assured you’ll be able to repay their loan along with your other debts. It’s helpful to have a back-up source of repayment, such as job income, in case something goes wrong with your business or project.

- Collateral: Assets owned by the borrower to be forfeited to the lender if you can’t repay the loan. The property being purchased often serves as collateral for real estate loans. For small business loans, banks often require the entrepreneur to put up their personal property if the business does not have any assets. However, Baltimore Community Lending does not require collateral for small business loans.

- Capital: Money you’re putting toward, or have put toward, the small business or real estate project. Investing in your business or project demonstrates your commitment and reduces the risk of default. An example might be a real estate developer putting down 10% of the cost of the property.

- Conditions: General circumstances relating to the loan, as determined by the lender. This could include your level of experience in the industry, the property location, etc. It could also include factors outside of your control such as the state of the supply chain or industry trends.

Click To Learn More About the 5 C’s Of Credit

As a mission-based community development financial institution, Baltimore Community Lending also evaluates a sixth C: Community. Specifically, the impact your project will have on the community and your relationship with the community. If your business or project has a social mission in the Greater Baltimore Metro area, we want to hear about it. Contact us if you’re interested in a small business or real estate loan:

Small Business

Phone: 410-319-0732

Email: SmallBusiness@bclending.org

Real Estate

Phone: 410-862-0938

Email: RealEstate@bclending.org